An Income Statement is the same as a Profit and Loss (P&L) Statement. These financial reports compare a company’s total revenue and total expenses, the difference between the two being either the company’s Net Profit or their Net Loss for the period.

Since the Income Statement only compares the revenue and expenses of a company to find the Net Profit/Loss, the only accounts featured in the Income Statement are those within the Revenue and Expense categories of the Chart of Accounts.

The Income Statement, or P&L, is based on two Generally Accepted Accounting Principles (GAAP): Historical Cost and Matching Expenses with Revenue. The Historical Cost principle states that the actual amount paid or received is the amount recorded, which is important to ensure the accuracy of the Income Statement. The Matching Expenses with Revenue principle states that revenue from business and expenses accrued by earning said revenue must be recorded in the same accounting period. This allows us to see an accurate depiction of the cost of doing business which allows us to determine whether the business is making a net profit.

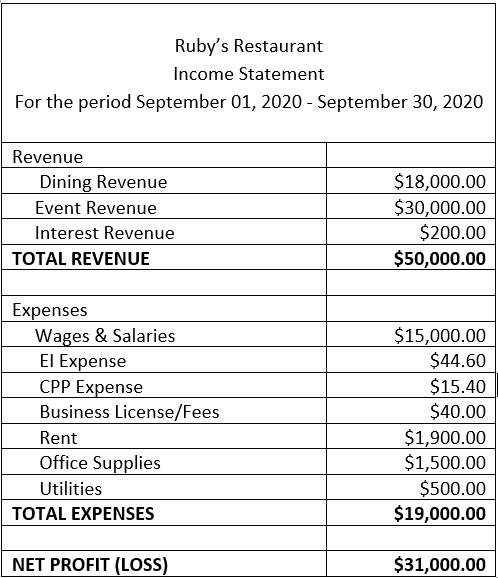

Please see below for an example of an Income Statement or Profit and Loss (P&L) Statement:

Chief Operations Officer

Ruby Business Solutions