A Balance Sheet, sometimes called a Statement of Condition, is a report comparing your business’ total Assets to its total Liabilities and total Equity. By comparing these things, the Balance Sheet shows the financial worth of your company at a specific point in time. A formula illustrating this comparison is:

Total Assets = Total Liabilities + Total Equity

Or

Total Equity = Total Assets – Total Liabilities

The accounts featured in a Balance Sheet are only those found within the Equity, Assets, and Liabilities categories of the Chart of Accounts, however on a Balance Sheet you will not find any account numbers, only account names. The information within the Balance Sheet is cumulative, this means that it includes information from the beginning of your company up to the specified date in time.

The Balance Sheet is based on the Adequate Disclosure principle of the Generally Accepted Accounting Principles (GAAP). The principle of Adequate Disclosure states that financial statements should contain all information necessary for a reader to understand the financial condition of a business, this is an integral part of the Balance Sheet as it is meant to convey the financial worth, or financial condition of a business.

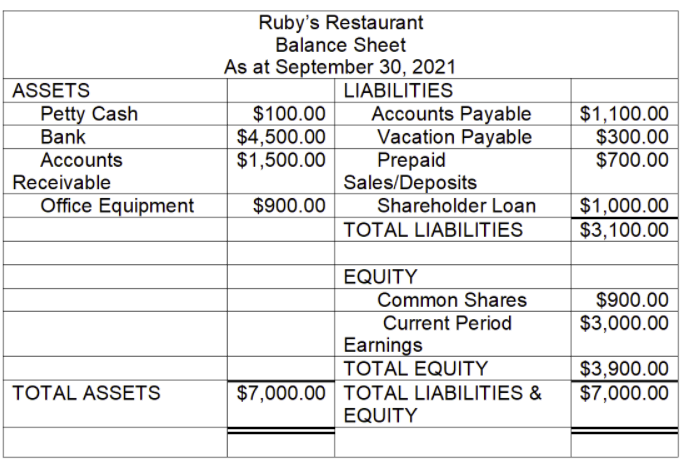

Please see below for an example of a Balance Sheet:

Chief Operations Officer

Ruby Business Solutions