Conversion costs are crucial to understanding the financial position of your company if your business involves production and inventory. Conversion costs refer to the cost of production required to convert the raw materials into a finished product to sell. This can be broken down into labour costs and manufacturing overhead costs, where manufacturing overhead costs includes all manufacturing costs except for the costs of the raw materials. Some examples of things that may be included in manufacturing overhead costs are:

- Rent paid for the factory

- Equipment maintenance and depreciation

- Insurance

- Tools and machinery

- Inspections

- Supplies required for production which are not raw materials

Often, unusual manufacturing overhead costs will be excluded from a businesses conversion cost since it does not give an accurate depiction of the day-to-day costs and the usual costs of production.

Why are conversion costs important?

Conversion costs provide you with more information to give you an accurate picture of the total cost of production of your goods. This means that when pricing your inventory to sell, you will be able to ensure that the value placed on your items includes all of the production costs involved in the process.

How do I calculate my conversion costs?

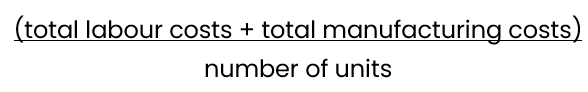

The first step to calculating your conversion costs is to determine what is included in them. You will want to include any direct labour costs as well as their related benefits and payroll taxes. You will also need to determine which costs are included in your manufacturing overhead. Once you have completed this, you can move onto the calculation:

Here is an example to help you calculate your conversion costs:

Ruby’s Manufacturing Co. incurs a total of $10,000 during December in direct labour and related costs, as well as $38,000 in manufacturing overhead costs (rent, tools, machinery, etc). Ruby’s Manufacturing Co. produced 20,000 units during December. Therefore, the conversion cost per unit for the month was $2.40 per unit.

To be sure you are calculating your conversion costs correctly, please consult your bookkeeper or accountant.

Chief Operations Officer

Ruby Business Solutions